In today’s digital age, the digital landscape is undergoing a profound transformation as digital identity solutions redefine the way we perceive and interact with our identities. This revolution promises a future where our smartphones serve as gateways to our entire identities, offering unparalleled convenience and security. Emerging technologies like artificial intelligence (AI) and machine learning (ML) will further enhance identity verification processes, making them more accurate and efficient. With Connected Identity comes the promise to dismantle the barriers that have hindered access to financial services, but also drive innovation and reshape our customer experiences.

The value of Connected Identity

Connected Identity can have a significant impact on the banking sector:

- Enhanced security, by using advanced authentication methods like biometrics and multi-factor authentication, connected identity helps reduce the risk of identity theft and fraud

- Improved accessibility, by allowing customers access to financial services anytime and anywhere, making banking more convenient

- Streamlined processes, by simplifying the onboarding & know your customer (KYC) procedures, reducing the need for physical documents and in-person verification

- Enhanced customer experience, by providing seamless and secure access to services

- Operational efficiencies, by reducing costs and improved efficiency by automating the identity verification processes.

Moving towards the future of banking

The challenge for many banks is that their digital innovations are often isolated, leading to inefficiencies and missed opportunities for holistic relationship development.

To thrive in the evolving financial landscape, the future bank must harness the power of data to make informed, customer-centric decisions. This involves a multi-faceted approach:

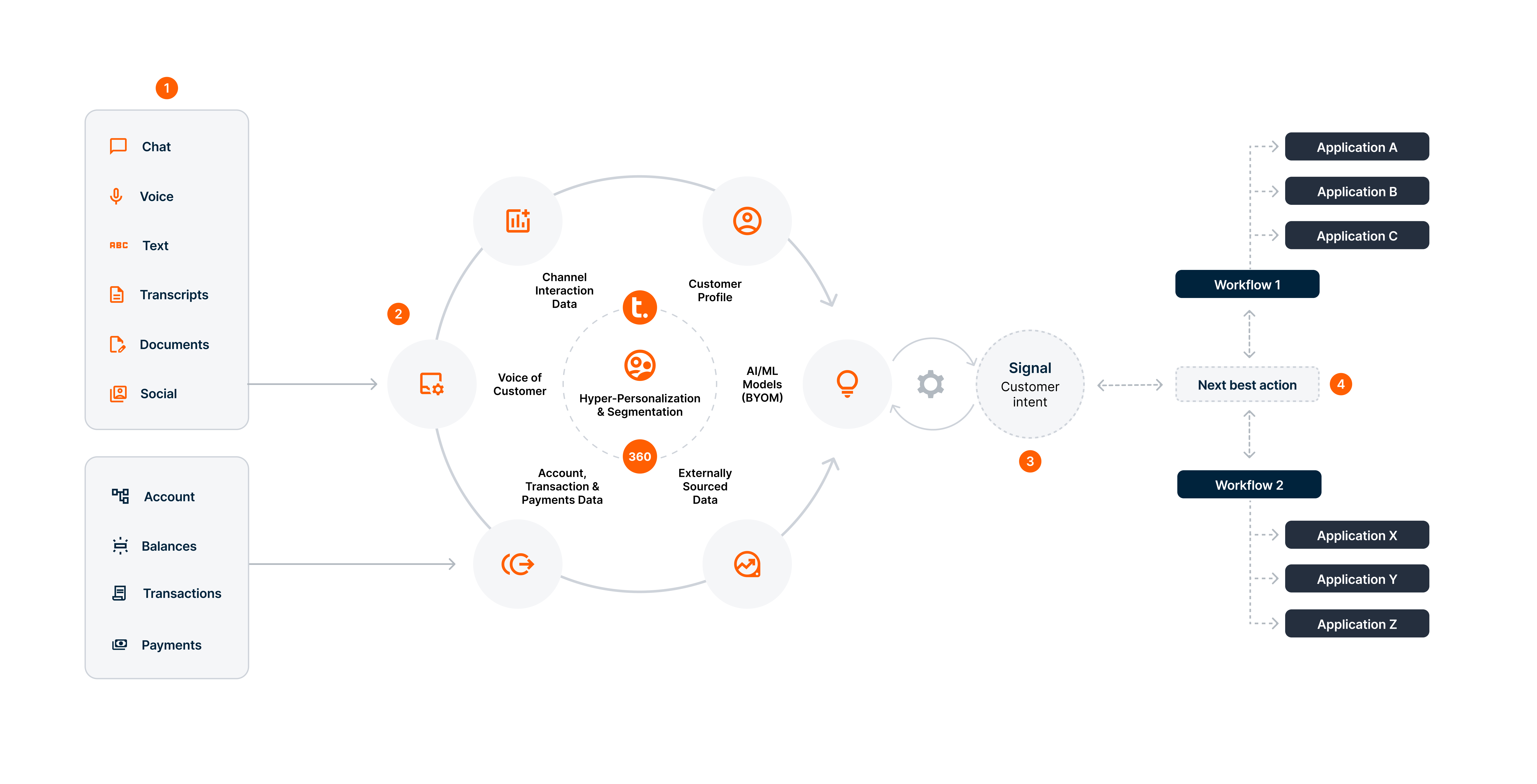

Firstly , banks need to leverage all customer-originated data. This includes not just transactional data, but also voice recordings, emails, documents, and social media interactions. By analyzing these diverse data sources, banks can gain a comprehensive understanding of customer needs and preferences, enabling them to optimize service delivery and enhance customer satisfaction.

Secondly, the development of Natural Language Processing (NLP) tasks is crucial. NLP allows banks to interpret and analyze both structured and unstructured data, making human-like decisions that provide actionable insights. This technology can help banks understand customer sentiments, detect fraud, and personalize customer interactions more effectively.

Secondly, the development of Natural Language Processing (NLP) tasks is crucial. NLP allows banks to interpret and analyze both structured and unstructured data, making human-like decisions that provide actionable insights. This technology can help banks understand customer sentiments, detect fraud, and personalize customer interactions more effectively.

Thirdly, it is essential to integrate these foundational models into the data and analytics workflow. This integration minimizes data movement, ensuring that data remains agile and accessible. By embedding these models within the workflow, banks can maintain the flexibility needed to adapt to changing market conditions and regulatory requirements.

Finally, banks must propagate and distribute the signals derived from data analysis into business workflows. This ensures that insights are not siloed but are instead disseminated throughout the organization, driving informed decision-making across all levels of the business.

By adopting these strategies, banks can navigate the complexities of the modern financial environment, delivering superior service and maintaining a competitive edge.

The future of banking is bright with the promise of data-driven insights, seamless customer experiences, and an unwavering focus on customer needs. As the industry evolves, banks that embrace these changes will not only thrive but also lead the way in innovation and excellence. By harnessing the power of transformation, your organization can achieve remarkable growth and success, setting new standards in the banking sector.

At Teradata, we help the leading global banks transform their business by leveraging our AI & data capabilities. If you would like to know more about how we can integrate your digital initiatives for a consistent, efficient, and superior customer experience across all touchpoints, please reach out.